Recently there have been credit cards getting compromised in the area. Be alert when using your department or personal credit cards. Card skimmers are one way your card could get compromised at fuel pumps or ATM’s. Perpetrators will place a skimmer at the pump temporarily and come back later to get the skimmer which retains your credit card information. Some skimmers may be placed inside of the cabinet panel at a gas pump. The most common will be done on the side of the pump that faces away from the cashier, so they aren’t seen tampering with the pump. Try to avoid independent ATM’s at bars or convenient stores, preferably use Bank ATM’s.

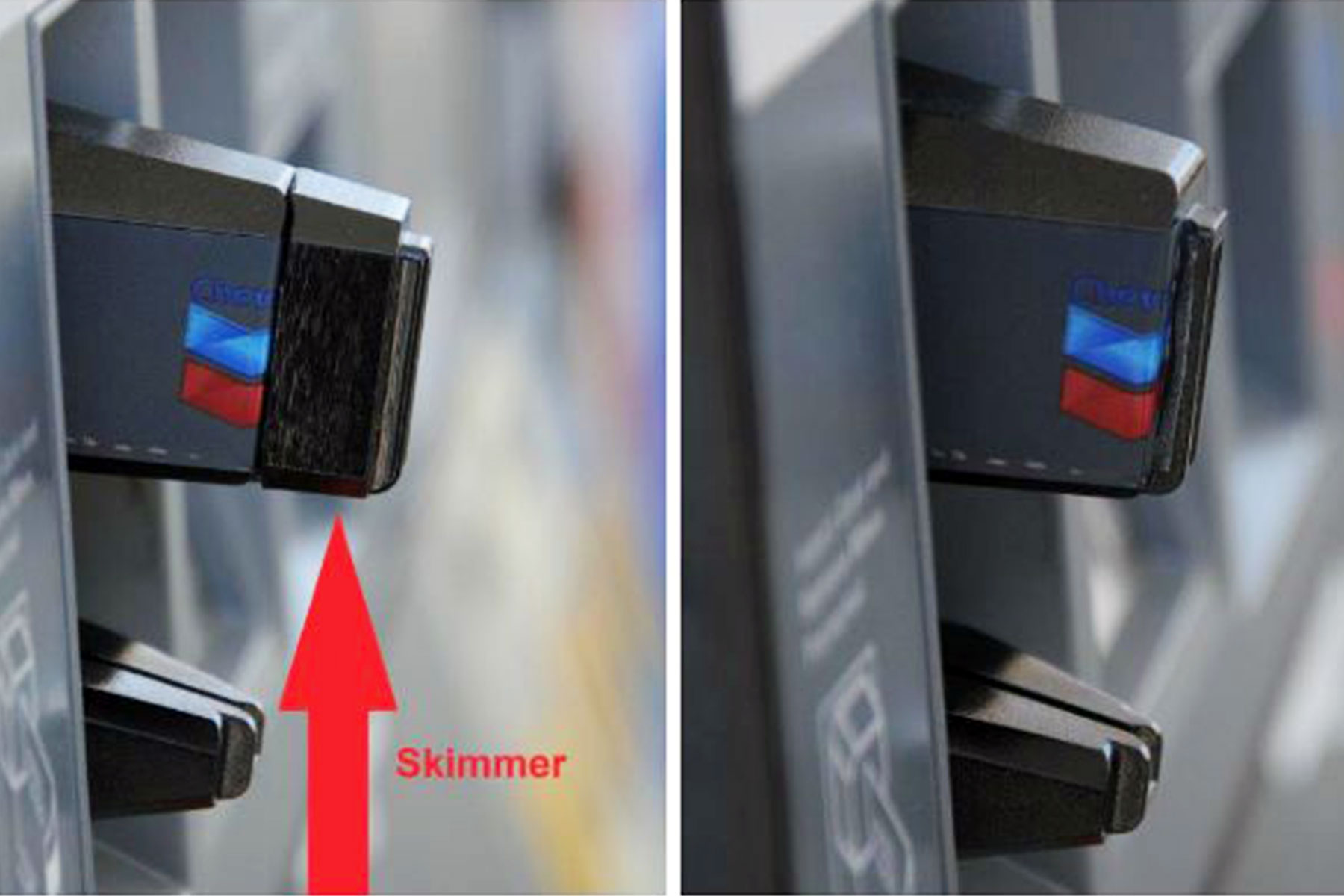

Although skimmers can be hard to spot, it’s possible to identify a skimming device by doing a visual and physical inspection.

Before using an ATM or gas pump, check for alignment issues between the card reader and the panel underneath it. Skimmers are often placed on top of the actual card reader making it stick out at an odd angle or cover arrows in a panel. Compare the card reader to others at a neighboring ATM or gas pump and look out for any differences.

Gas pumps should have a security tape or sticker over the cabinet panel. If the tape looks ripped or broken, avoid using the card reader because a thief may have tampered with it. Try looking inside the card reader to see if anything is already inserted – if there is, it may be a thin plastic circuit board that can steal card information.

A physical inspection of a card reader and keypad can often reveal fraudulent devices. Feel around the reader and try to wiggle it to see if it can easily come out of place. Also make sure the gas pump panel is closed and doesn’t show signs of tampering. Many stations now put security seals over the cabinet panel. If the pump panel is opened, the label will read “void.”

If you use a debit card at the pump, run it as a credit card instead of entering a PIN. That way, the PIN is safe and the money isn’t deducted immediately from your account.

If you’re really concerned about skimmers, pay inside rather than at the pump. Monitor your credit card and bank accounts regularly to spot unauthorized charges.

If your credit card has been compromised, report it to your bank or card issuer. Federal law limits your liability if your credit, ATM, or debit card is lost or stolen, but your liability may depend on how quickly you report the loss or theft.