Twenty years ago, the Southern Ute Indian Tribe created the Southern Ute Growth Fund to organize and manage its business activities. A key aspect of this initiative was diversification of the Tribe’s investments to include real estate holdings as another source of income beyond its oil and gas operations. It was a smart strategic decision. Real estate has been used as an investment tool for centuries because it is a stable and dependable business that is easy to value. It generates reliable cash flows through stable income properties such as multifamily apartments and commercial buildings where tenants pay monthly rent, the buildings become more valuable over time, and can ultimately be sold for a profit.

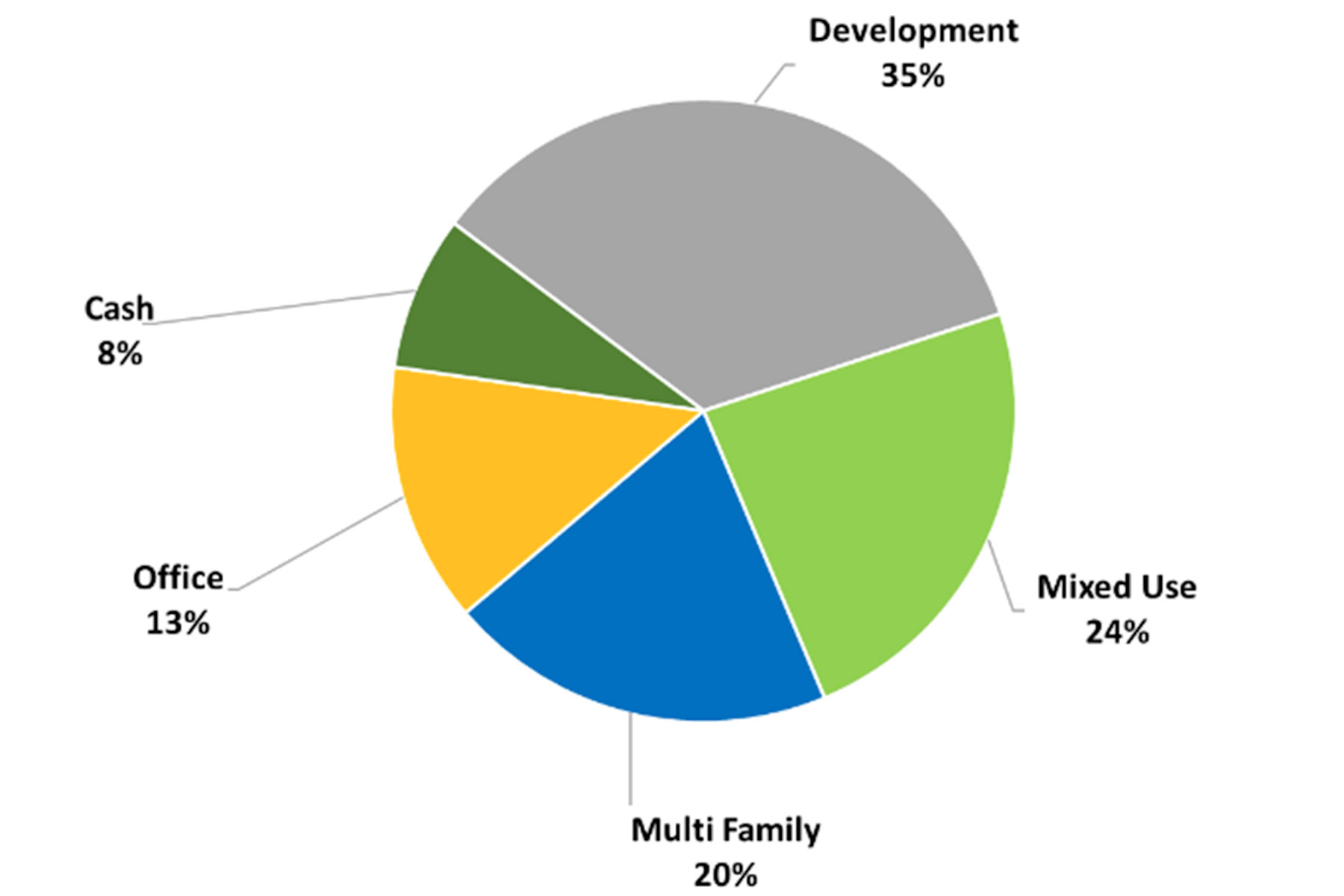

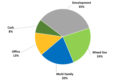

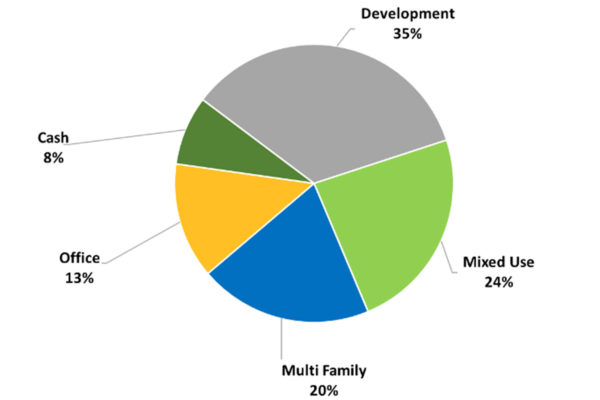

As of September 30, 2010

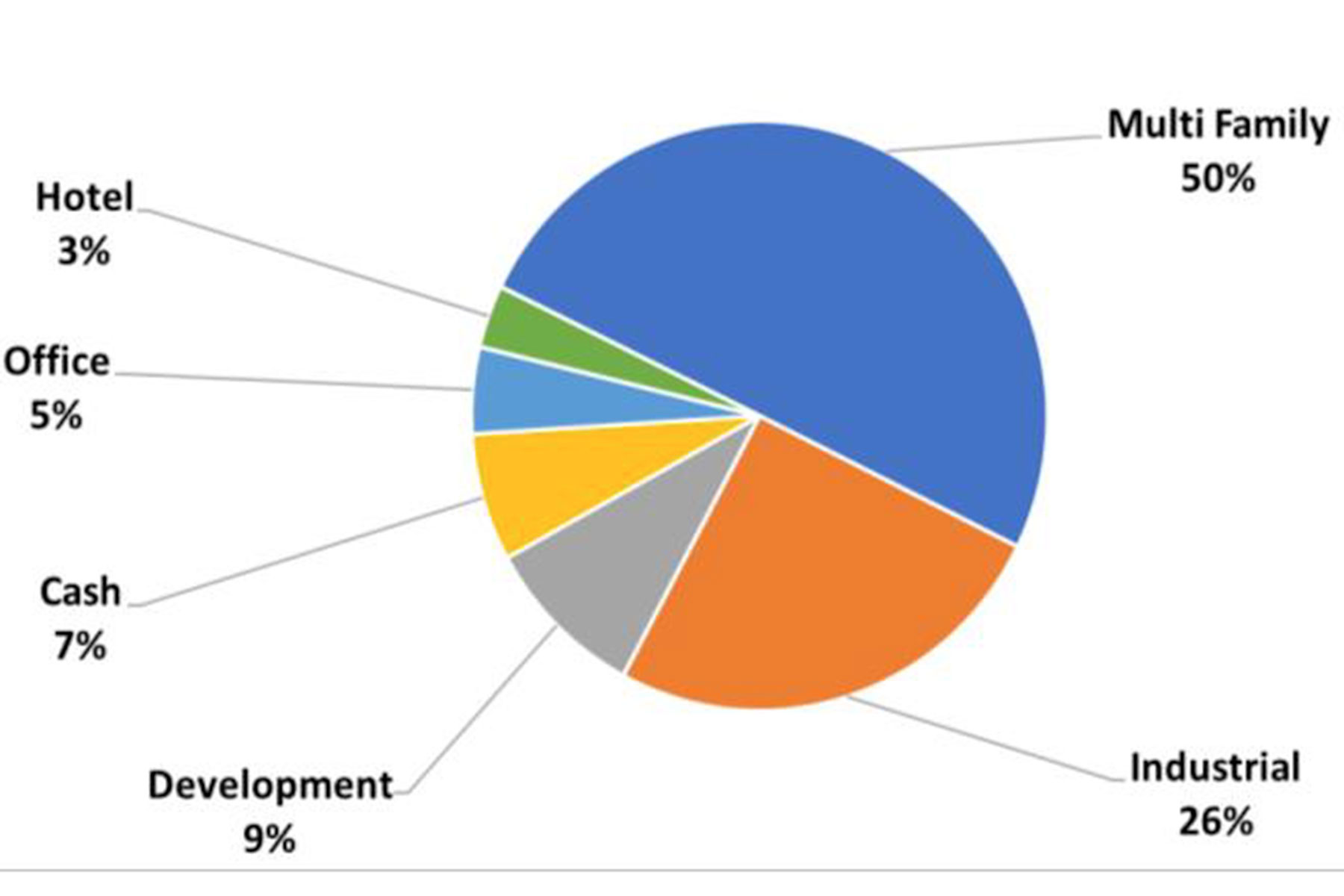

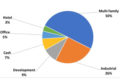

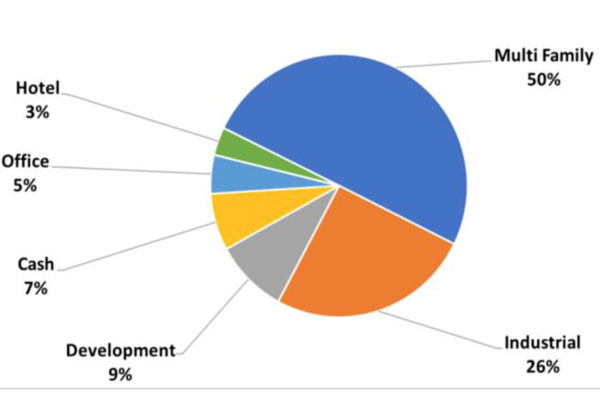

As of September 30, 2020

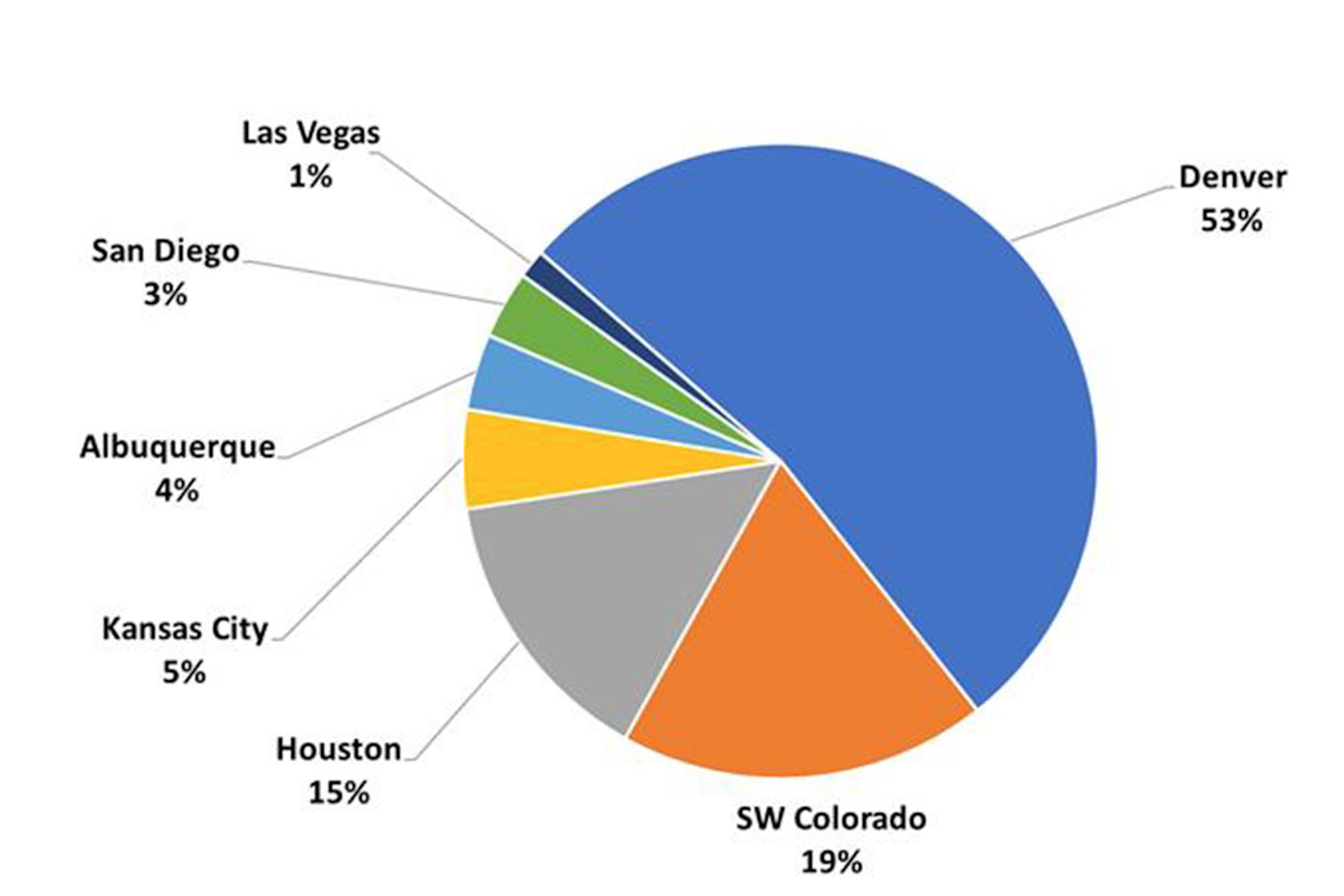

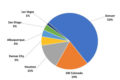

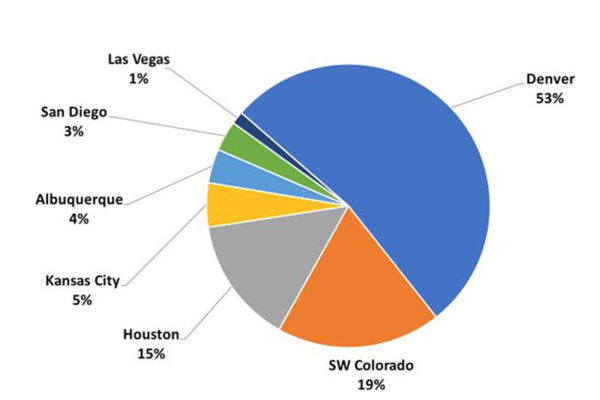

As of September 30, 2010

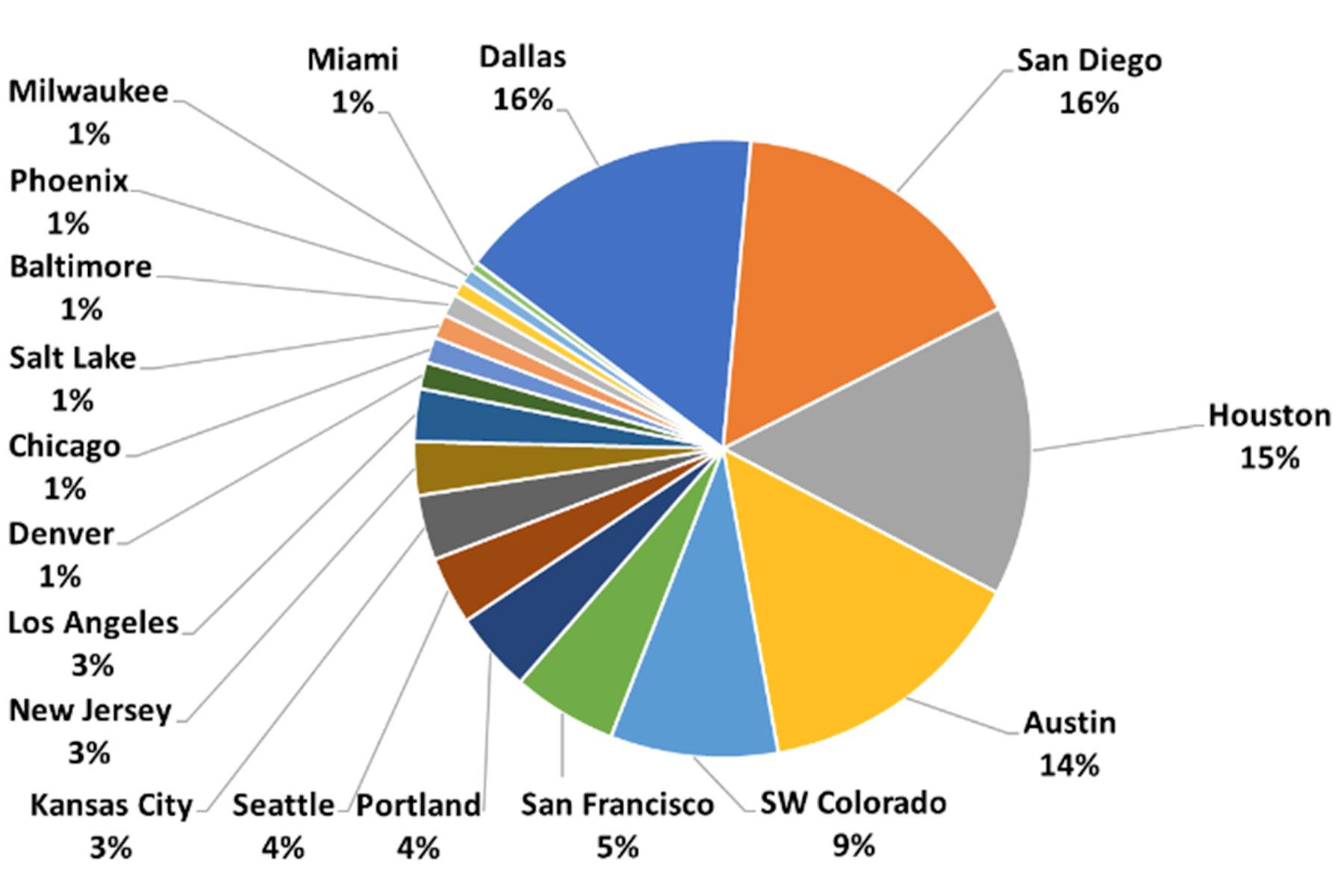

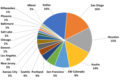

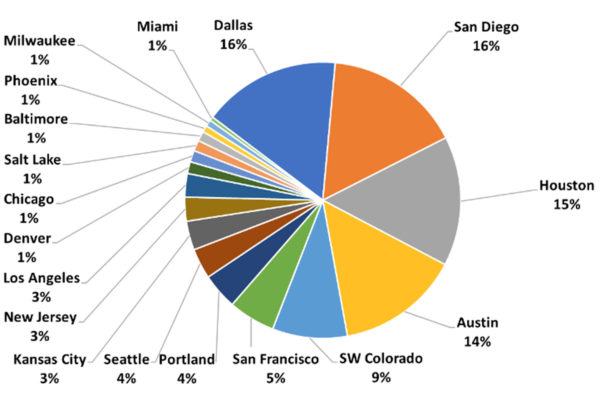

As of September 30, 2020

Real estate also includes land development projects which generate revenue from lot sales to home and commercial builders. Additionally, real estate is a core component of a diversified business portfolio, serving as an inflation hedge and as a buffer for other investment types during times of economic recession.

The Tribe’s real estate portfolio was launched in the early 2000’s. Back then, the assets were concentrated mainly in single tenant office buildings and included the Three Springs master-planned land development project in Durango, Colo. Over subsequent years, the Tribe expanded its portfolio and began investing in development projects such as: Belmar (a 1 million square foot mixed-use project in the Denver area); Candelas (a large master-planned land development project also in the Denver area); and The Spire (a Denver condominium project), along with multifamily apartments primarily in Texas.

In 2013, following the Great Recession, the Tribe consolidated all of its real estate companies under GF Properties Group (GFPG) and began to reduce its concentration in development projects and invest in a higher percentage of income properties across a greater number of geographic markets to reduce risk and maximize revenues. In 2010, the Tribe owned real estate assets in just seven U.S. markets, of which 72% were in Colorado and nearly 60% concentrated in development and mixed-use projects, which tend to be more sensitive to economic downturns than income properties.

Now in 2020, the GFPG portfolio looks much different with properties in 18 U.S. markets coast to coast. The portfolio includes 14 industrial properties, nine multifamily apartment projects, two office buildings, two master-planned communities, and one hotel. Over 80% of these assets are income properties that generate stable revenue for the Tribe year over year. This stability has been demonstrated during the COVID-19 pandemic with minimal disruption to earnings and cash flow.

GFPG currently has targeted an asset allocation of 60% Multifamily; 30% Industrial; and 10% “Other” in major growth markets. This asset allocation is preferred because of the risk profiles of each asset class. Multifamily apartments are attractive because, as demonstrated during past recessions, the length and severity of the downturn in multifamily apartments are typically lower than other asset types. This sector tends to be less sensitive to changes in overall economic activity because people always need a place to live. Industrial assets complement multifamily apartments because industrial users typically sign longer term leases. The industrial asset class is projected to outperform all other classes over the next five years due to a continuing shift in consumer product distribution from traditional retail stores to next-day or two-day home delivery.

Another important aspect of real estate investment is the strategic use of conservative and inexpensive mortgage debt to enhance returns. Mortgage debt allows GFPG to own more assets which leads to greater diversity, less risk, more earnings and ultimately improves returns.

GFPG also sells properties from time to time. The primary goal when selling a property is to maximize investment returns. Some of the common reasons to sell are: 1) trends of local market economies; 2) realize full appreciation in an asset; 3) generate cash flow for new investments and further diversification; 4) new long-term lease is signed which creates strong value; and 5) trading up to newer asset(s).

Over the years, GFPG’s philosophy on how best to invest in real estate has been shaped by careful research and analysis of market trends and changing demographics. By remaining vigilant over the forces that impact the performance of its property assets, GFPG will continue to make sound strategic decisions on where, when, and how to invest. Ultimately, real estate investment is a smart and profitable means of generating consistent income for the Tribe and represents an important component of the Tribe’s diverse businesses.