Pana-qaru ‘uru ‘apagharu

“Money Talks”

Retirement accounts across the country are suffering, according to a new survey by personal finance company MagnifyMoney (https://www.magnifymoney.com/). Some Americans have either stopped contributing to their retirement accounts or have decreased their contributions because of the coronavirus crisis. Even worse, Americans are pulling money out of their retirement accounts to pay for essentials.

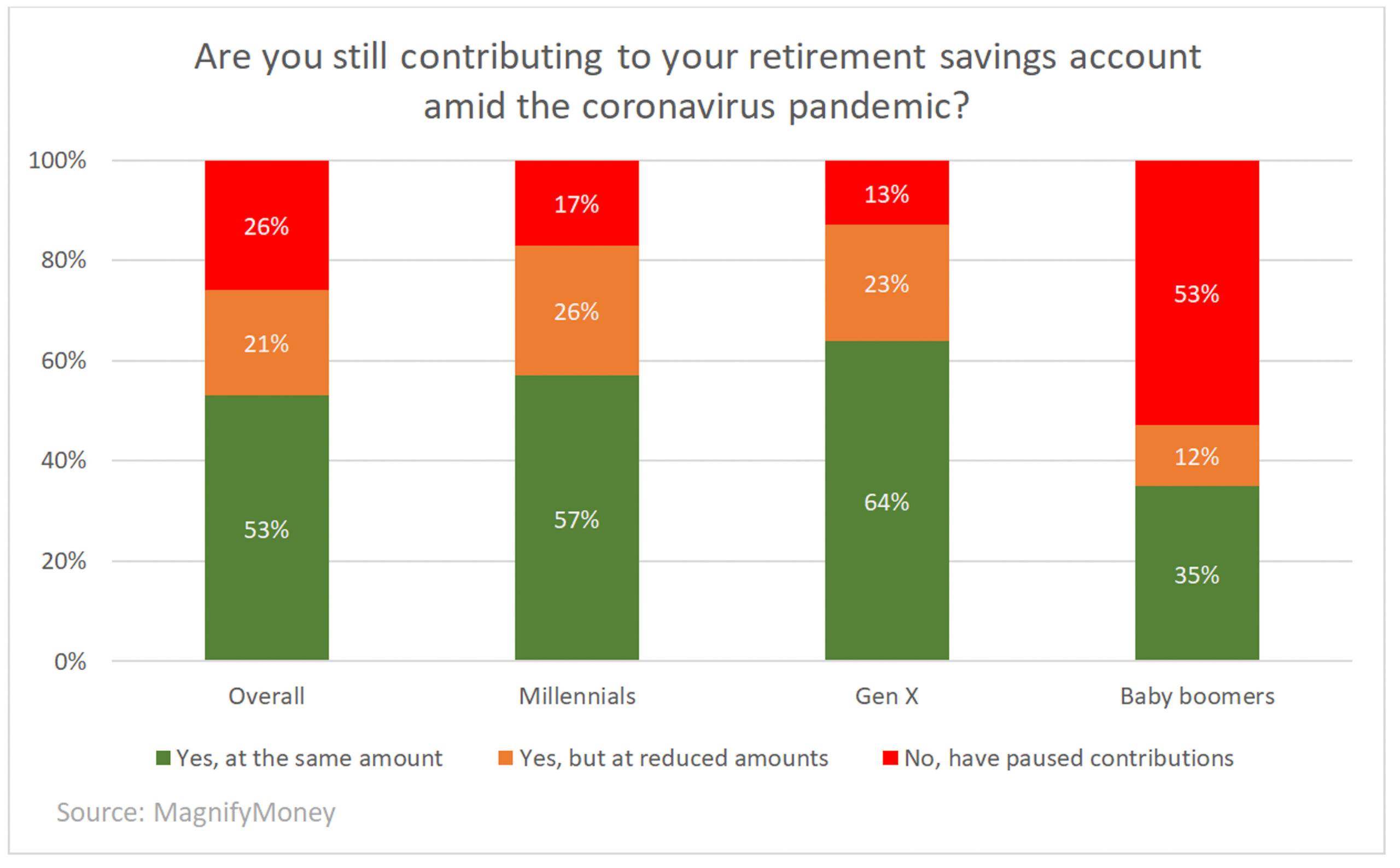

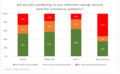

The survey went out to people of all ages who had a retirement savings account. When asked the question “Are you still contributing to your retirement savings account amid the coronavirus pandemic?“, almost half of all respondents said they had either stopped their contributions or at least lowered them.

And as you can see, the Baby Boomer generation (ages 55 to 74) has been impacted the most.

This is troubling because folks in their 50s and 60s are the ones who need to keep their contributions steady. No one wants to get to the finish line only to find out that their retirement savings are insufficient and that they have to continue to work.

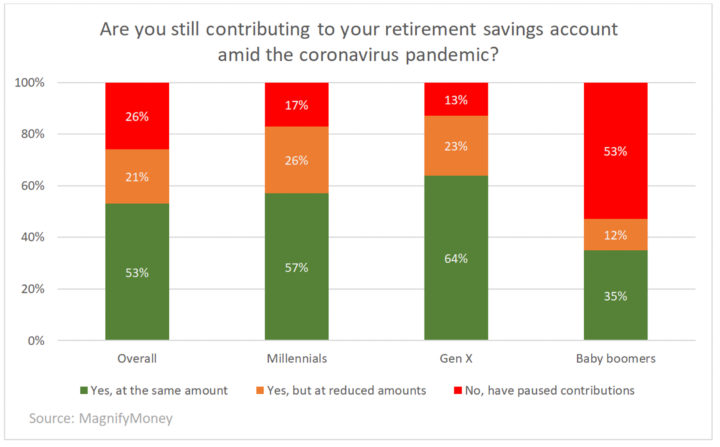

One of the most concerning outcomes of the survey is that half of Americans have either pulled money from their retirement accounts in the last two months, or they plan to shortly.

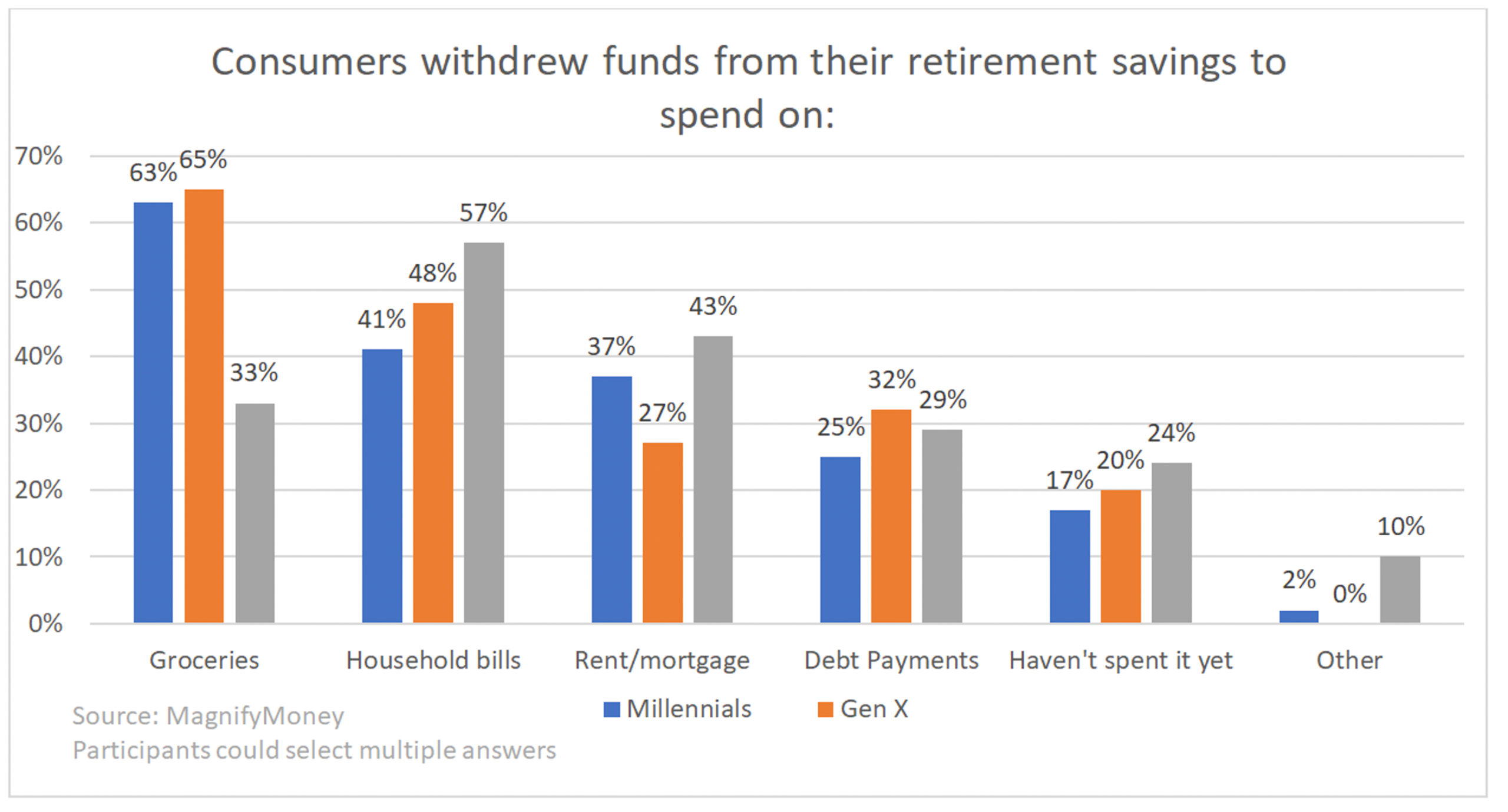

Some of this can be explained by individuals taking advantage of new legislation allowing penalty-free withdrawals. But the majority of people pulling money from retirement accounts are doing it to cover day to day expenses.

The majority of Baby Boomers said they needed the money to go towards household bills. The majority of millennials and Gen Xers needed the funds for groceries.

It makes sense that folks are searching for ways to come up with cash. More than 36 million jobless claims have been filed in the last two months. And the unemployment rate exceeded 14 percent in April 2020 (according to the U.S. Bureau of Labor Statistics), a level which hasn’t been seen for decades.

It’s unfortunate that many have had to turn to their retirement nest eggs to cover necessary expenses. Many people in the U.S. have adopted the attitude of just surviving this crisis, but don’t forget about an important goal: being able to retire when you want and live comfortably during retirement.

Today, let’s go over three important topics: Your retirement savings rate, housing, and other debt levels, and how much you need in case of an emergency.

- How much should you save each year for retirement?

If you want to achieve financial success in life, you need to save; there is no other way around it. You can’t rely on the Federal government or anyone else to take care of you when you enter your golden years. If you haven’t saved enough money, it will be hard to live the retirement lifestyle you are hoping for.

You should have a goal to save at least 15 percent of your pre-tax income. This includes employee and employer contributions.

Let’s say you work for an organization with a retirement plan like the Tribe and have an annual salary of $50,000. If you contribute five percent of that to your 401(k) plan and your employer matches your contribution up to four precent as well as six percent profit sharing, you’ll end up saving $7,500 each year. You are saving 15 percent of your salary, but don’t forget to save from other sources of income you have.

In the long term, you’ll need to start saving more. Of course, how much you need to save depends on your age when you start saving, and what your anticipated costs will be after retirement. If you started saving early, your savings will benefit from compound interest (please see prior article on compound interest for more information https://www.sudrum.com/eEditions/DrumPDF/2020/SUDrum-20200228.pdf ).

But if you haven’t started, start now and put a plan together to continue to increase your savings rate at least annually. One way to do this is to schedule an automatic annual increase to your retirement savings that aligns with your pay increases. That way, when your salary increases, so does your savings rate.

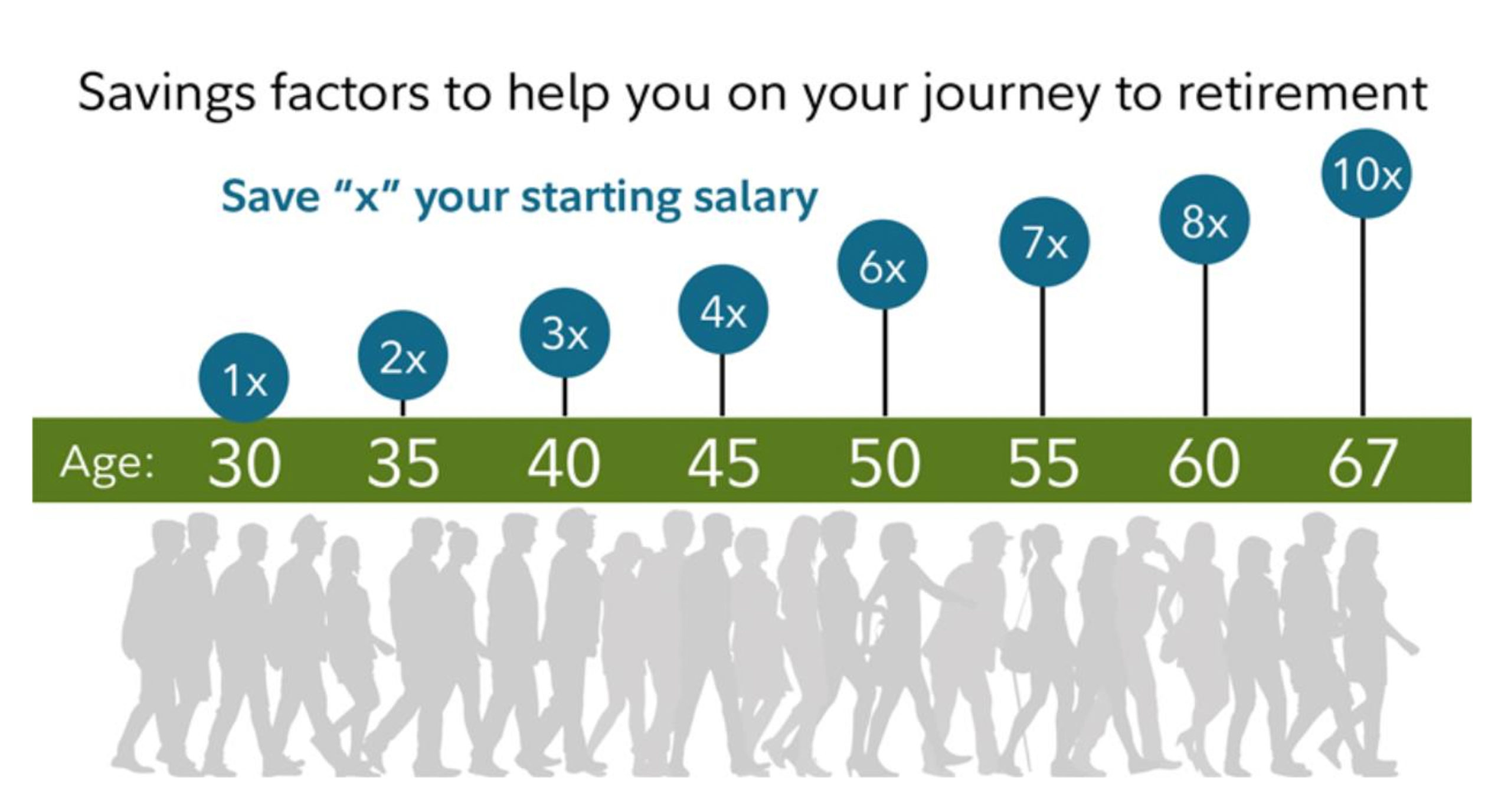

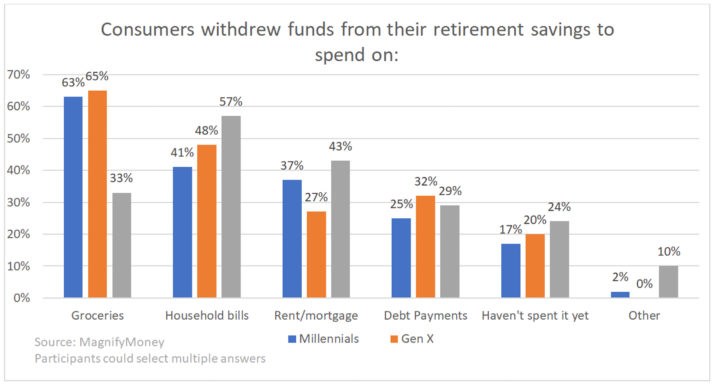

Every situation is different, but in general, you should follow these guidelines from Fidelity (the Tribe’s 401k provider) for how much you should have in your retirement savings. In the graphic below, the x is a benchmark for how much you should have saved by what age – for example, if you are 40 years old and earn $50,000 per year, you should have $150,000 ($50,000 salary times 3) in retirement savings to be on track. If you are not on track, you may want to plan to increase your retirement savings rate. https://www.fidelity.com/

If you have children, grandchildren, or nieces and nephews starting out in their careers, please be sure to stress the importance of saving. The earlier the better.

And even if you haven’t been saving since age 25, it’s never too late to start. Make saving money a priority. Make it a habit. Go without a $100 meal once a month and sock that money away for retirement instead.

- How much debt should you have?

For most of us, a house is the most expensive purchase we will ever make. You want a house that you can live comfortably in, but you also don’t want to get in a hole paying a mortgage or rent you can’t afford.

As a general rule, your housing costs should be less than 28 percent of your gross pay.

Housing costs include principal, interest, taxes, and home insurance. So, if your total housing costs are $2,000 each month, you’ll need a monthly income of at least $7,142 per month, or about $85,000 per year.

If you calculate your housing costs and you are over 28 percent, you are paying too much for your housing, and it might be time to downsize.

And as you approach your retirement age, your housing costs should decrease and only make up about 5 percent of gross pay.

Also, if you throw in other debt such as car loans, student loans, or credit-card payments, your total debt shouldn’t exceed 36 percent of your gross salary, unless you are nearing retirement age.

Here’s the formula… (Housing Costs + Other Debt Payments) / Gross Pay ≤ 36 percent interest rates are really low, but debt levels still need to be managed. Keep this formula in mind when you’re thinking about taking on more debt.

And ideally, your total debt should be about 10 percent or less of gross pay for someone nearing retirement age.

- How much of a rainy-day fund should you have?

You should always have about three to six months worth of expenses in cash, savings, or other items that are easy to convert to cash.

In case you lose your job, you may need savings for unexpected costs such as medical bills, unexpected car repairs or, if a virus spreads across the world causing much of the economy to shut down.

Be sure that when you calculate your monthly expenses, you include items such as groceries, education, clothing, and insurance. Don’t include discretionary expenses like vacations or a new car. In times of emergency, you can go without those.

How much you need in your emergency fund also depends on your situation. If you are the sole provider in your family, you should have an emergency fund closer to six months worth of expenses. If you and your spouse are both employed and both bring in roughly the same income, you could probably get away with three months worth of expenses.

But no matter what, always have an emergency fund of a minimum of three times your monthly expenses. This should be the minimum goal for all households.

If in times of crisis you need to dip into your emergency fund, make it a priority to replenish it as soon as possible.

Coronavirus and unemployment headlines are dominating the news right now, and that’s what most folks are talking about. But don’t lose sight of your financial goals.

No matter what age you are: save, keep your debt levels under control, and always be prepared for an emergency.

Also, did I mention the importance of saving?

If you want to learn more about saving, retirement, or budgeting, here are some resources for you to consider:

https://www.decoda.ca/read-all-about-lit/five-indigenous-financial-literacy-resources/

If you’d rather have a face-to-face discussion with someone, there are a number of local advisors and you should find one you are comfortable with. Here’s a place to start your search: https://www.letsmakeaplan.org/

If you have any questions, please feel free to contact me. Lorelei Cloud, Treasurer, Southern Ute Indian Tribe at 970-563-0100 or via email locloud@southern ute-nsn.gov.

Toghoyagh!