Is your cash making money?

Maykh,

Have you ever wished that you could have more money, without all the effort? There is actually a simple way to accomplish this, if you are willing to learn how to put your money to work for you. It’s called compound interest, and it can help you significantly grow your wealth. When people think of interest, they often think of debt. But interest can work in your favor when you’re earning it on money you’ve saved and/or invested. For example, the money you deposit into a savings account at the bank can be borrowed and used by that bank, and for this privilege, the bank pays you interest.

Compound interest can be defined as interest earned on the initial deposit (or principal) in addition to interest on the accumulated interest from previous periods. Think of it as a cycle of earning “interest on interest.” Compound Interest will make a deposit or loan grow at a faster rate than simple interest – which is interest calculated only on the principal amount. Not only are you getting interest on your initial investment, but you are getting interest on top of interest! It’s because of this that your savings can grow exponentially, and why the idea of compounding returns is like putting your money to work for you.

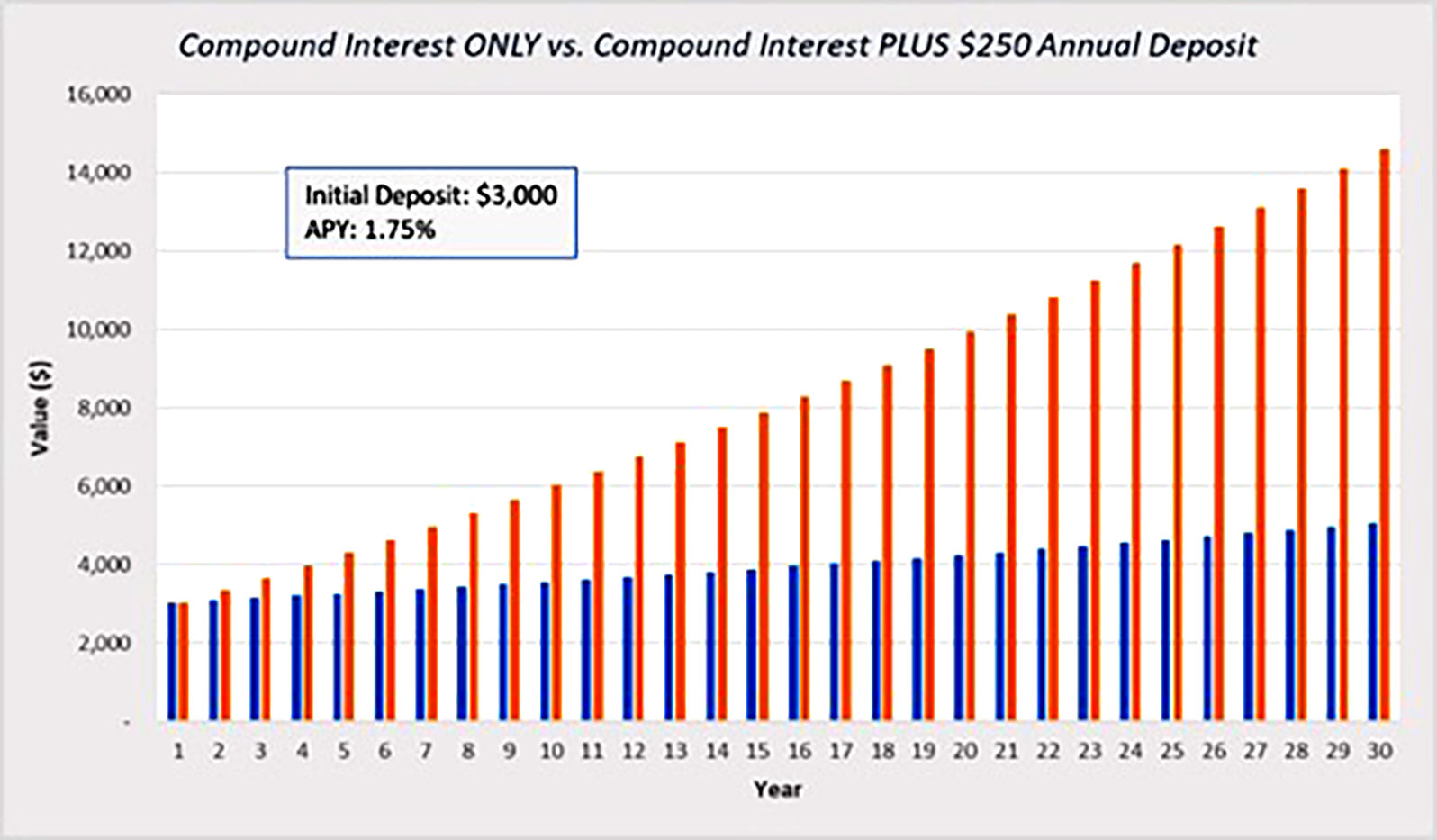

Let’s consider an example: Say you put $3,000 in a savings account with an annual percentage rate (APR) of 1.75% a year, and your account compounds interest monthly. After one year, your balance would be about $3,053. This means your money would grow by $53 without the need for any additional deposits. Then for the next 12 months, that $53 will continue to earn interest, along with the original deposit of $3,000. Without touching your account, you would have about $3,107 at the end of the second year.

If you continued to allow this balance to grow at the same 1.75% APR, your balance after 30 years would be $5,069. But, what if you added a little each year? If you deposited just $250 each year, it would accelerate your savings balance to $14,595 in 30 years.

Further, the more often compounding happens, such as monthly as opposed to annually, the faster the growth. That’s because each calculation is made based on the latest account balance, and if compounding happens monthly, the balance is slightly bigger each month, so the interest rate is applied to bigger and bigger sums each month.

The magic ingredient that makes compound interest work best is time. The simple fact is that when you start saving outweighs how much you save. Time is your best friend and the one thing that makes compound interest so effective. Saving now and starting early will pay dividends in your future and help you accumulate extra money.

So, we have learned that you can have more money, without much effort at all, by taking advantage of compound interest. And we have learned that the single most important variable is time — the sooner you start saving, the better. Then the second most important variable is interest rate (or rate of return).

You may have heard of the ‘rule of 72’ as an easy way to quickly calculate the number of years it will take for your investment to double. Simply take the number 72 and divide it by the percent annual interest. For example, an investment with a rate of 6% will double in 12 years (72 ÷ 6% = 12yrs); while our prior example with an interest rate of 1.75% will take a little more than 41 years to double (72 ÷ 1.75% = 41.1yrs). Clearly, when earning interest, you want to earn at the highest rate possible.

Today, interest rates are at historic lows; the average savings account pays a measly rate less than 0.1%. But if you pay attention and do a little homework you can find online savings rates of 1.5%, or higher. Don’t let these low rates deter you! The key is to start now and contribute what you can. It may not seem like it’s worth it, but even small contributions of $25-$100 per month add up over time. And as we all know, interest rates do fluctuate. Prior to the great recession in 2008, average savings account interest rates were better than 4%.

Don’t wait for higher rates! Compound interest favors those who start early, which is why it literally “pays” to start now. It’s never too late to start – or too early.

Resources:

- www.businessinsider.com/every-interest-rate-cycle-since-1970s-2015-12#september-18-2007-to-present-13

- windgatewealth.com/the-power-of-compound-interest-and-why-it-pays-to-start-saving-now/

- www.nerdwallet.com/blog/banking/what-is-compound-interest/

- money.cnn.com/2013/10/01/pf/savings-account-yields/index.html

- www.cnbc.com/2019/02/11/how-compound-interest-works-and-how-it-can-help-you-save-money.html

- blog.wealthfront.com/compound-interest/

- www.bankrate.com/banking/savings/rates/

- Meade Harbison, Business Development Specialist, Southern Ute Growth Fund