Your credit score – a three-digit number lenders use to help them decide how likely it is they’ll be repaid on time – is an important factor in your financial health. A good credit score can open doors for you. From helping you qualify for the best interest rates and terms when you borrow money to influencing how much you pay for life insurance, some might be doors you never even knew existed.

Why are credit scores important?

1. Your credit score can help you when you borrow money. If you want to buy a house, you will almost definitely have to take out a mortgage. Many people also borrow in order to buy a car. A good credit score can save you thousands of dollars over the life of a loan.

For example, you may get a better mortgage interest rate with a high credit score than you would with a lower score. On a 30-year mortgage for $200,000, the savings can be significant. If you can get a rate of 4.29 percent on a $200,000 mortgage, your total interest paid will be $155,884. But if you have a lower credit score and only qualify for a rate of 5.5 percent, you will instead pay $208,808 in interest over the life of the loan, or nearly $53,000 more. On top of that, you will also have a higher monthly payment.

The better your credit score, the more you can save when you decide to borrow.

2. Your credit score can impact your insurance premiums. With a lower score, you could end up paying more each month for coverage. However, you could pay hundreds of dollars less in insurance premiums over your lifetime by improving your creditworthiness and positively impacting your credit score.

3. You may qualify for better terms when you sign up for rent, utilities, cable, and/or Internet services. Landlords will sometimes consider your credit score when you apply to rent. Wireless communication companies might look at your scores before they lease you your next smartphone. Many Internet and TV providers now check your credit before they set you up with service. In some cases, if your credit is poor enough, you might be denied an account. Even if you aren’t denied service, you might have to pay a security deposit or pay some part of your service up front.

4. Access to better financial deals. When you have good credit, you have access to better financial opportunities. You may be able to refinance your home to a lower interest rate. You might have access to better rewards credit cards with lower interest rates. You might even be offered bank accounts, investment accounts, and credit cards with perks reserved for customers with better credit.

What’s in a credit score?

The three major credit reporting agencies are: Experian, Equifax, and TransUnion. Each credit reporting agency has a different scoring model, so your credit score will vary among agencies. Below are the factors that are typically used to calculate your credit scores, by the level of impact they can have on your scores.

High impact

Credit card utilization: This refers to how much of your available credit you’re using at any given time. It’s determined by dividing your total credit card balances by your total credit card limits. Most experts recommend keeping your overall credit card utilization below 30 percent, because lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too much on it.

Another benefit of keeping your utilization low? Having available credit can help if something unexpected arises which you then must pay for.

Payment history: This is represented as a percentage showing how often you’ve made on-time payments. Late or missed payments can significantly harm your credit scores, so it’s important to try to pay all your bills on time.

Derogatory marks: As of July 1, 2017, about half of all tax liens and nearly all civil judgments have been removed from consumers’ credit reports. That’s good news, because having those derogatory marks on your reports can lower your credit scores. Other derogatory marks that may affect your credit include accounts in collections, bankruptcies and foreclosures.

Medium impact

Age of credit history: This factor shows how long you’ve been managing credit. While your average age of accounts isn’t typically the most important factor used to calculate your credit scores, it’s important to think about. Closing your oldest credit card account, for example, could end up negatively impacting your scores.

Low impact

Total accounts: This refers two the number of credit cards, loans, mortgages and other lines of credit you have. Lenders generally like to see that you have used a mix of accounts on your credit responsibly.

Hard inquiries: Hard inquiries usually occur when you apply for a new line of credit, such as a loan, credit card or mortgage, but can also take place when you rent an apartment. A lot of hard inquiries on your credit reports within a short time period may suggest that you’re desperate for credit or aren’t getting approved by other lenders.

What’s not in a credit score?

Salary, age and employment history don’t factor into your credit scores. Other things that don’t go into your scores include:

- Race/ethnicity

- Religion

- Nationality

- Gender

- Marital status

- Where you live

- Your total assets

Also, while soft inquiries may be included on your credit reports, they don’t affect your scores. These generally occur when a person or company checks your credit as part of a background check — think employer background checks or pre-qualified credit card offers.

How Credit Scores Are Calculated

You likely have dozens, if not hundreds, of credit scores. That’s because a credit score is calculated by applying a mathematical algorithm to the information in one of your three credit reports, and there is no one uniform algorithm employed by all lenders or other financial companies to compute the scores. (Some credit scoring models are very common, like the FICO® Score*, which ranges from 300 to 850.)

You don’t have to get hung up on having multiple scores, though, because the factors that make your scores go up or down in different scoring models are usually similar. Most scoring models consider your payment history on loans and credit cards, how much revolving credit you regularly use, how long you’ve had accounts open, the types of accounts you have and how often you apply for new credit. Because there are different credit scoring models, how factors are weighted can vary slightly from model to model.

How do you improve your credit score?

Improving your credit scores takes time, but the sooner you address the issues that might be dragging them down, the faster your credit scores will go up. A credit score reflects credit payment patterns over time, with more emphasis on recent information. Payment history and credit utilization ratios are among the most important in many critical credit scoring models, and together they can represent up to 70% of a credit score, which means they’re hugely influential. Focusing on the following actions will help your credit scores improve:

1. Pay Your Bills on Time

When lenders review your credit report and request a credit score for you, they’re very interested in how reliably you pay your bills. That’s because past payment performance is usually considered a good predictor of future performance. You’ll want to pay all bills on time—not just credit card bills or any loans you may have, such as auto loans or student loans, but also your rent, utilities, phone bill and so on. It’s also a good idea to use resources and tools available to you, such as automatic payments or calendar reminders, to help ensure you pay on time every month.

If you’re behind on any payments, bring them current as soon as possible. Although late or missed payments appear as negative information on your credit report for seven years, their impact on your credit score declines over time: Older late payments have less effect than more recent ones.

2. Pay off Debt and Keep Balances Low on Credit Cards and Other Revolving Credit

A low credit utilization ratio tells lenders you haven’t maxed out your credit cards and likely know how to manage credit well. It is calculated by adding all your credit card balances at any given time and dividing that amount by your total credit limit. For example, if you typically charge about $2,000 each month and your total credit limit across all your cards is $10,000, your utilization ratio is 20%. Lenders typically like to see ratios of 30% or less. You can positively influence your credit utilization ratio by paying off debt and keeping credit card balances low and/or becoming an authorized user on another person’s account (as long as they use credit responsibly).

3. Apply for and Open New Credit Accounts Only as Needed

Don’t open accounts just to have a better credit mix – it probably won’t improve your credit score. Unnecessary credit can harm your credit score in multiple ways – from creating too many hard inquiries on your credit report to tempting you to overspend and accumulate debt.

4. Don’t Close Unused Credit Cards

Keeping unused credit cards open—if they’re not costing you money in annual fees—is a smart strategy, because closing an account may increase your credit utilization ratio.

5. Don’t Apply for Too Much New Credit, Resulting in Multiple Inquiries

Opening a new credit card can increase your overall credit limit, but the act of applying for credit creates a hard inquiry on your credit report. Too many hard inquiries can negatively impact your credit score.

6. Dispute Any Inaccuracies on Your Credit Reports

You should check your credit reports at all three credit reporting bureaus (TransUnion, Equifax, and Experian) for any inaccuracies. If you see errors, dispute the information and get it corrected right away.

How Long Does It Take to Rebuild a Credit Score?

If you have negative information on your credit report, such as late payments, a public record item (e.g., bankruptcy) or too many inquiries, you should pay your bills and wait. There is no quick fix for bad credit scores. The length of time it takes to rebuild your credit history after a negative change depends on the reasons behind the change:

Delinquencies remain on your credit report for seven years.

Most public record items remain on your credit report for seven years, although some bankruptcies may remain for ten years.

Inquiries remain on your report for two years.

How do you Establish or Build Your Credit Scores?

If you simply don’t have a credit score because you have little experience or history with credit, you likely have a thin credit file. That means you have few (if any) credit accounts listed on your credit reports. Generally, a thin file means a bank or lender is unable to calculate a credit score, because there is not enough information in a user’s credit history to do so.

There are things you can do to improve your credit profile, such as applying for a secured credit card, becoming an authorized user on someone else’s credit card or taking out a credit builder loan.

What You Might Not Know About Credit Scores

In addition to knowing the most important factors considered in credit scoring, it can be helpful to know a few other facts about credit reports and credit scores. These components tend to be the most important:

Late payments appear for seven years from the date you first missed a payment.

Paying off a collection account won’t immediately remove it from your credit report.

Bankruptcies can remain on your report for seven to ten years, depending on the type of bankruptcy.

You don’t need to carry a monthly credit card balance to build your credit history. You can pay off your credit card bills every month and positively affect your credit standing.

Settling accounts for less than the full amount you owe can harm your credit scores. Any time you fail to repay a debt as you originally agreed, it can negatively affect your credit. That said, the negative impact of settlement is still less than the negative effect of not paying a debt at all or declaring bankruptcy.

The good news is, all negative information will eventually cycle off your credit report. Until it does, focus on the things you can positively influence, including paying all your bills on time.

Considering how critical credit scores are to your overall financial well-being, it’s wise to do everything you can to ensure yours are as good as possible. Rebuilding your credit or improving your credit scores takes time – there are no shortcuts. Regularly checking your credit report and knowing your credit scores are most important. Then, by recognizing the basic credit score factors, you can maintain and improve your credit health with confidence.

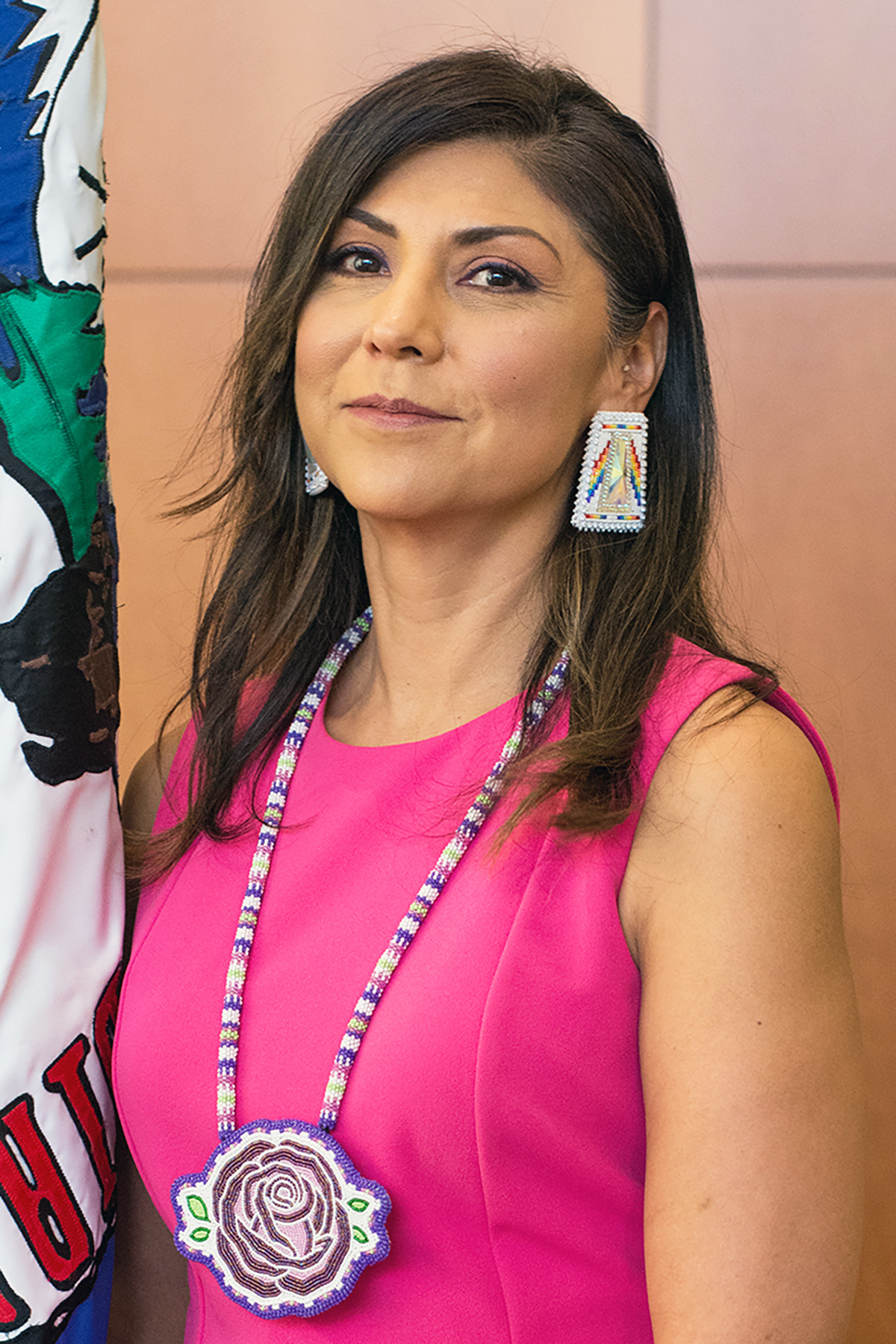

I’m always here for my Tribal Members. If you have questions or concerns, please don’t hesitate to reach out to me.

Credit: Miranda Marquit and Experian for contributions to this article.