How you manage money affects your ability to meet your family’s present and future needs. When you make choices about managing your money, it’s important to consider all of your options. Sometimes we don’t consider a certain option, because we don’t have any information or experience with it. Checking and savings accounts are often not used in Native communities, although these accounts are the safest and least expensive ways to manage money.

Financial institutions offer checking and savings accounts, so you have a safe and secure place to keep your money. You can deposit and withdraw money from both checking and savings accounts.

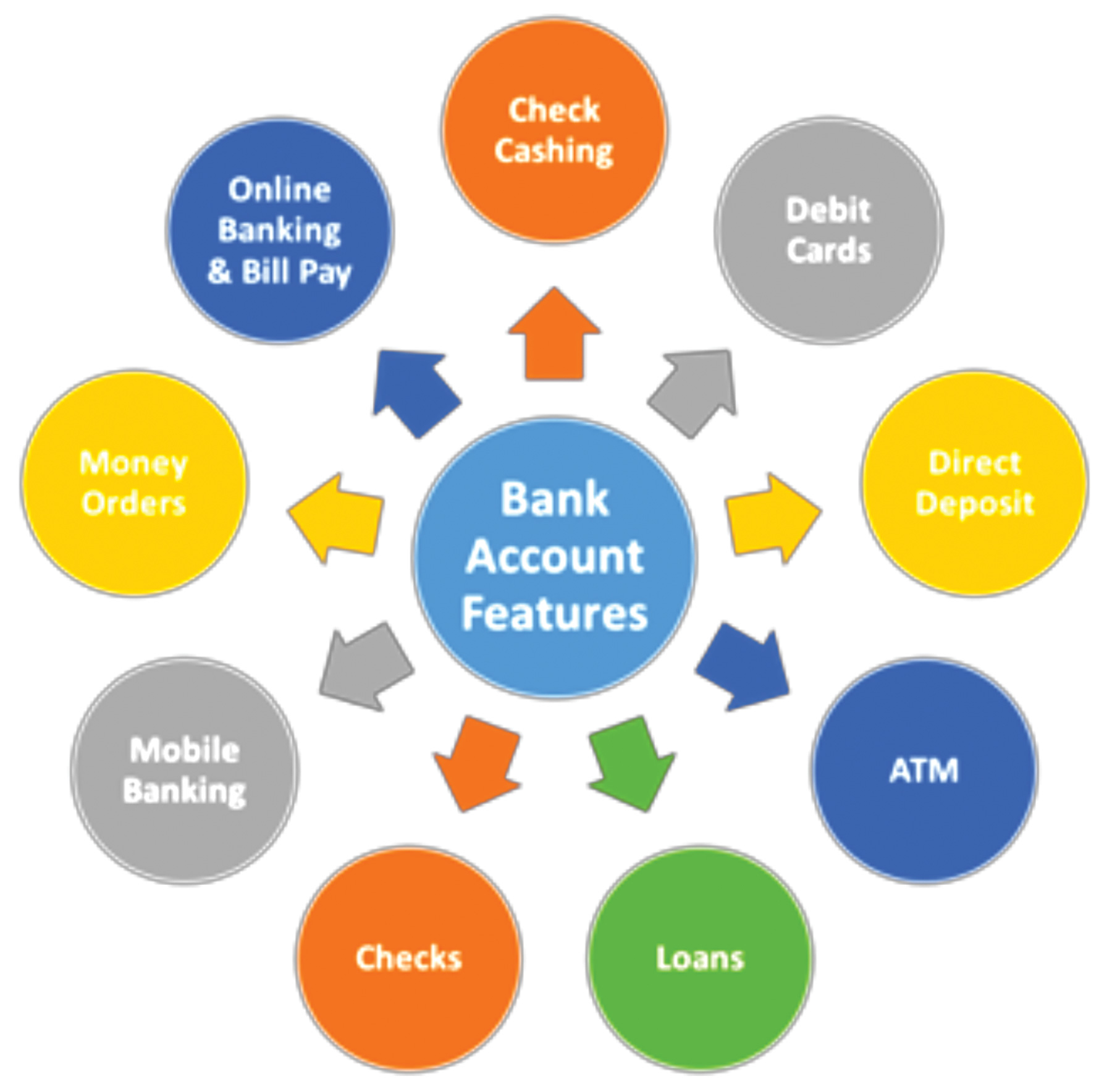

Common features of an account include the following:

- Checks – Checks are used for paying bills and making purchases when you do not want to use cash or debit cards.

- ATM – An ATM, or an automated teller machine, is a machine you can use anytime to handle your financial transactions. Many ATMs allow you to electronically do the same transactions you do at a teller window such as withdraw cash, make a deposit, check account balances, receive a copy of your statement, and transfer money between accounts. Be careful to guard your PIN number when using ATMs and pay attention to the fees being charged for ATM use.

- Debit Card – A debit card is a plastic card, sometimes called a “check card”. It is branded with either a VISA or MasterCard logo that can be used at a Point of Sale (“POS”) terminal to pay for goods or services.

- Online Banking/Bill Pay – Online banking allows access to your savings and checking account to view account activity, view statements, make payments, transfer funds between accounts, and see copies of checks you’ve written. This service is efficient, paperless, and available 24/7.

- Direct Deposit – Direct deposit allows paychecks to be directly deposited into your bank account. Your deposit is available immediately.

- Mobile Banking – Mobile banking allows access to your accounts via your smartphone, similar to online banking, but from anywhere.

- Money Orders/Cashier’s Checks – Money Orders and Cashier’s Checks are similar to personal checks, you can use them to pay bills or make purchases when cash is not accepted. There is a fee to get them, however.

- Loans – A loan is money you borrow with the intent to repay the financial institution at a later time. With a loan, the financial institution will charge you fees and interest to borrow money.

- Check Cashing – If you don’t have a bank account, cashing a check can cost a lot of money. Businesses such as check cashing stores, grocery stores, and casinos will almost always charge a fee for this service, usually a percentage of the check’s total. However, banks will cash checks for free, if you have an account with them.

Just keep in mind that some accounts have fees and others do not. When you open your account with a financial institution they will provide you with a list of fees related to your account.

Sometimes a financial institution will pay you for keeping your money in an account at their institution. This payment is called interest. The interest you receive is calculated as a percentage of the total funds you have in your account. If you do not take money out of your account, the balance continues to grow. Interest is a powerful tool, because it’s money you don’t have to work for. Instead the money in your account does the work for you.

The interest rates that banks pay on deposits can change periodically. Sometimes bank accounts earn quite a bit more or less interest than other times. The overall economy has a lot to do with how interest rates are determined, and through much of the current decade interest rates on any types of bank accounts have been under one percent. Regardless of how low interest rates might be, don’t let them discourage you from saving money.

Research suggests that children who have a bank account do better in school (especially in math), are more likely to go to college, and are more likely to be financial savvy as adults than those who do not. Therefore, a parent or guardian should consider opening a child’s first savings account by no later than his or her fifth birthday.

OPENING AN ACCOUNT

Steps to follow when you open an account:

- a) Before opening your account, go over any questions you have either in person with a representative at the financial institution or by calling and speaking with a representative over the phone. You can also research bank account features online.

- b) Decide what type(s) of accounts fit your needs. (checking, savings, certificate of deposit, etc.).

- c) Decide how you will open and fund your new account. Many financial institutions now offer the convenience of opening accounts online or over the phone, however, if you feel more comfortable opening your account in person that’s what you should do.

- d) Gather the necessary documents or information you will need to open your account (e.g. driver’s license, government issued ID, utility bill to verify address, social security number, etc.).

- e) Decide who you will list as beneficiary on your account.

- f) Complete all necessary application and account agreement forms either in person or online. Then save copies of all documents, either as hard copies or electronically, and create a filing system for accurate recordkeeping of these materials and future ones.

- g) You will receive your account number. Safeguard this number along with other critical account information (e.g. account username, password, and personal identification number “PIN”).

- h) Order checks and debit cards, if not already provided.

- i) Make your first deposit into your account. Cash will work if you open your account in person, but if you open your account online you’ll need either a debit card, credit card, or possibly a check from an existing account. A pre-paid debit card might work too.

- j) Sign up for online banking, download your financial institution’s mobile banking app, activate your debit card, and review your account policy materials and the features your account offers. Then, enjoy the many features and tools of your new bank account.

Next time, we will discuss how to manage and use your accounts effectively. As always, please don’t hesitate to contact me with any questions.

Toghoy-aqh