In this installment of Pana-qaru ‘uru ‘apagharu we are going to talk about the basics of Cash Flow. What do we mean when we say “cash flow”? In its simplest form, your personal cash flow is the money you have coming in (wages, distributions, etc.), minus the money you spend (mortgage, car payment, utilities, etc.).

Do you know what your monthly cash flow is? Many of us don’t. We are way too busy trying to get through the day to make the time to look at all that is coming in and going out on a daily, weekly, monthly, or yearly basis. I implore you – TAKE THE TIME! It can be an eye-opening experience. Plus, it’s liberating to take control of your finances. It gives you a sense of accomplishment and helps you to set financial goals for you and your family – the benefits of which can be realized for years to come.

In this day and age, there are many ways to track and calculate your cash flow, you just need to find what works best for you:

- Online banking

- A calendar

- A number of potentially free mobile apps

- A financial journal

- Spreadsheets

- Software programs

- And others!

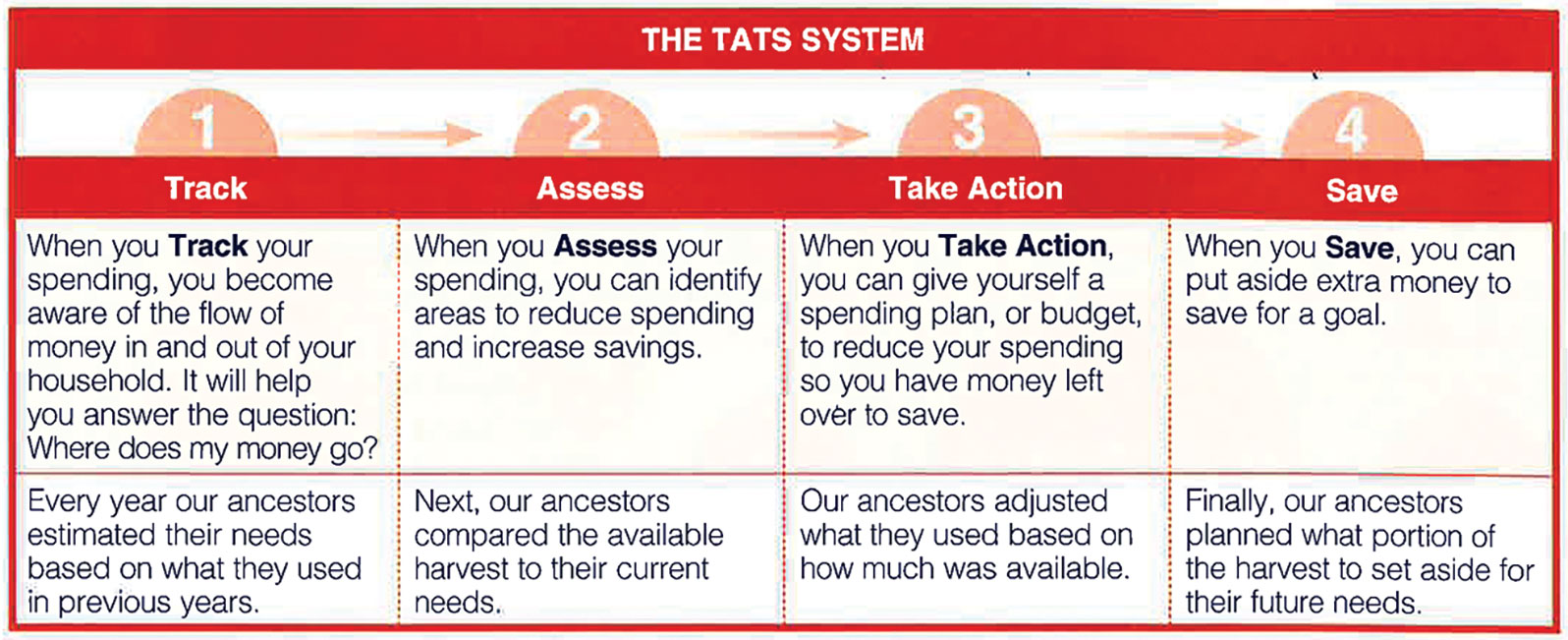

So, where do you start? Throughout the coming installments of Pana-qaru ‘uru ‘apagharu, we will be referring to something called the TATS System. “TATS” stands for Track, Assess, Take Action, and Save. This month we are focusing on the “T” – Tracking. Ideally, you would track your income and expenses over the course of an entire year to take into account special events suc h as: Christmas, birthdays, vacations, etc. That may seem daunting, but just start the process by looking at the last month or two. It will get easier and you will get better at it over time.

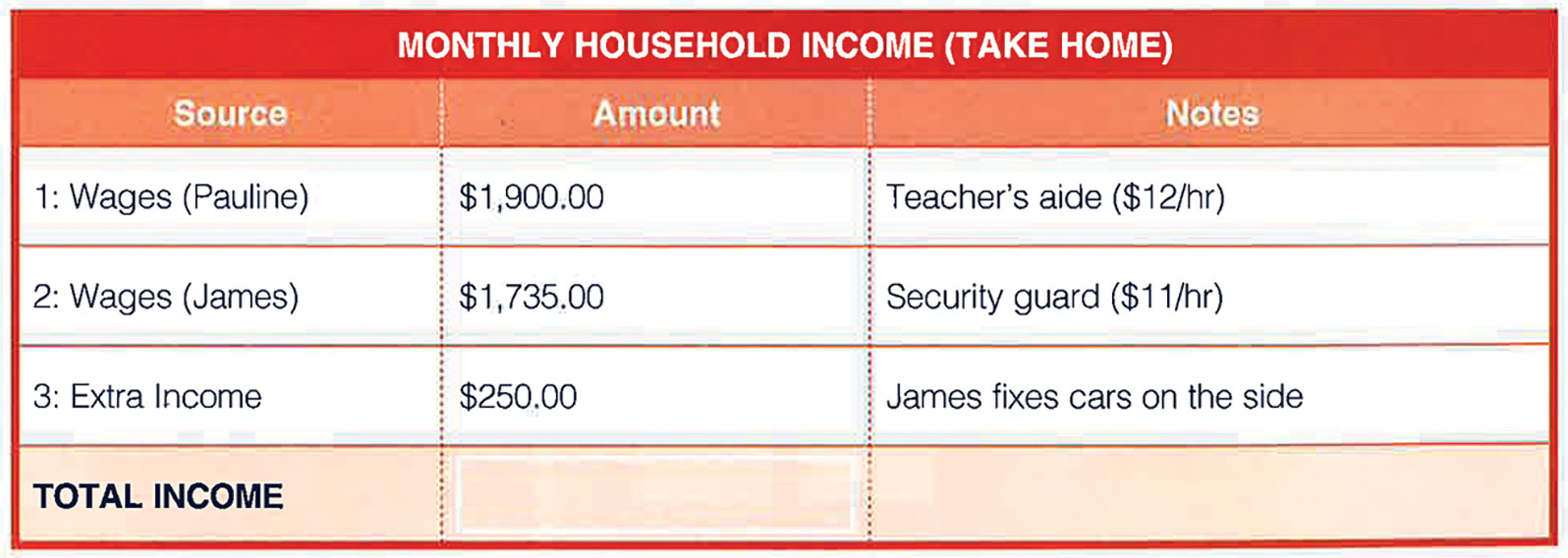

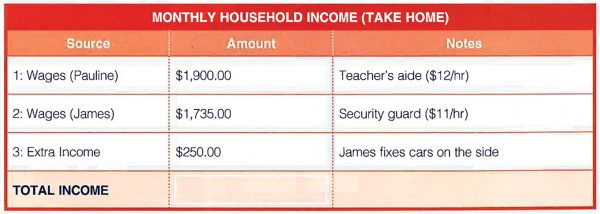

Simply because I would rather focus on the positive first, let’s start with what’s coming in: Income. To understand your income, you should track how much money comes into your household – obvious right? This can include income from many sources: job, per capita payments, side jobs, interest and earnings from investments, etc. Here’s a simple example to show what I mean. Remember, track your income after taxes!

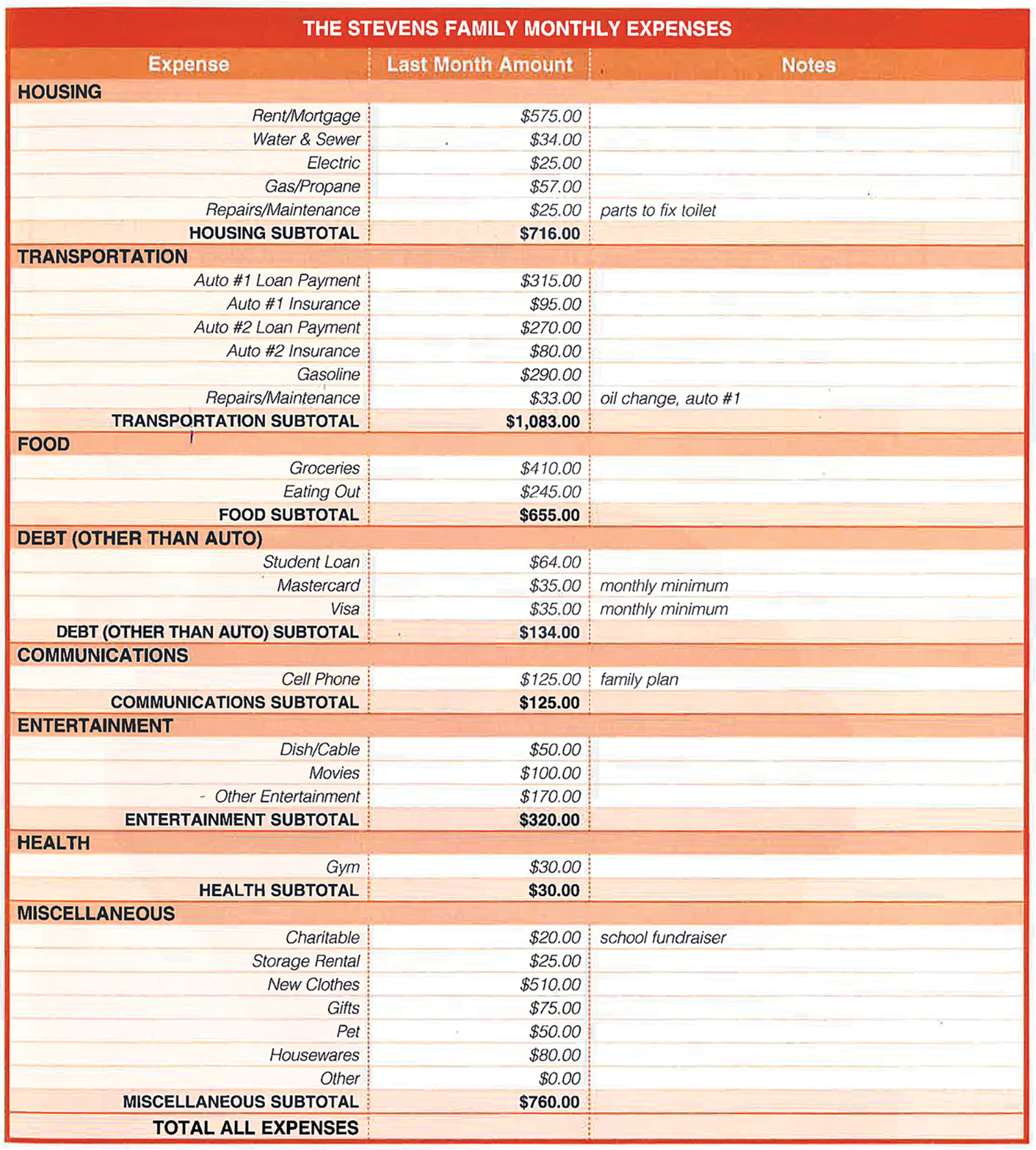

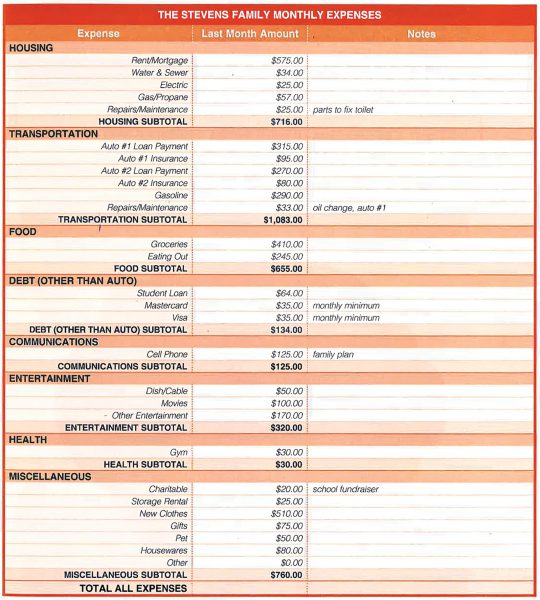

Next, let’s look at the money going out: Expenses. When you add up all your spending for the month, what are your monthly expenses? Let’s walk through a simple exercise to show what we are talking about. Use the following exhibit as a guide, but adapt it to your specific situation. Also, take the additional step of marking each expense as either a “NEED” or a “WANT”. We will get more into that when we cover Spending Plans at a later date, but for now try to acknowledge all the ways (and on what) you spend money.

Now that you have tracked your monthly income and expenses, there’s one more step to take – you need to compare the money coming in to your household expenses. Is total income greater than total expense? If it is, great! That means you have Savings! We will talk about savings and investment plans a little further down the road. If not, then you need to take a serious look at how you are making ends meet. Are you living on credit? Loans from family and friends? That is not a sustainable situation and you need to take action now. Start by taking control of your spending habits and apply strict discipline to spending money only on things you cannot live without.

This is not always a simple thing to do. I encourage you to keep tracking your cash flow. Go back as far as you have records. Analyze the monthly trends and what motivates your spending behavior. We will revisit this topic in a couple months when we examine Spending Plans. Next month, we are going to look at the Tribal and local economies and how you personally can help make it stronger.

SOURCES

Financial workflow charts for this article originally published in Building Native Communities: Financial Skills for Families. First Nations Development Institiute and First Nations Oweesta Corp.